Renters Insurance in and around Honolulu

Looking for renters insurance in Honolulu?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

No matter what you're considering as you rent a home - price, internet access, location, condo or townhome - getting the right insurance can be essential in the event of the unpredictable.

Looking for renters insurance in Honolulu?

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

When the unanticipated break-in happens to your rented home or space, often it affects your personal belongings, such as a laptop, a tool set or a set of golf clubs. That's where your renters insurance comes in. State Farm agent Sue Ann Lu has a true desire to help you evaluate your risks so that you can protect your belongings.

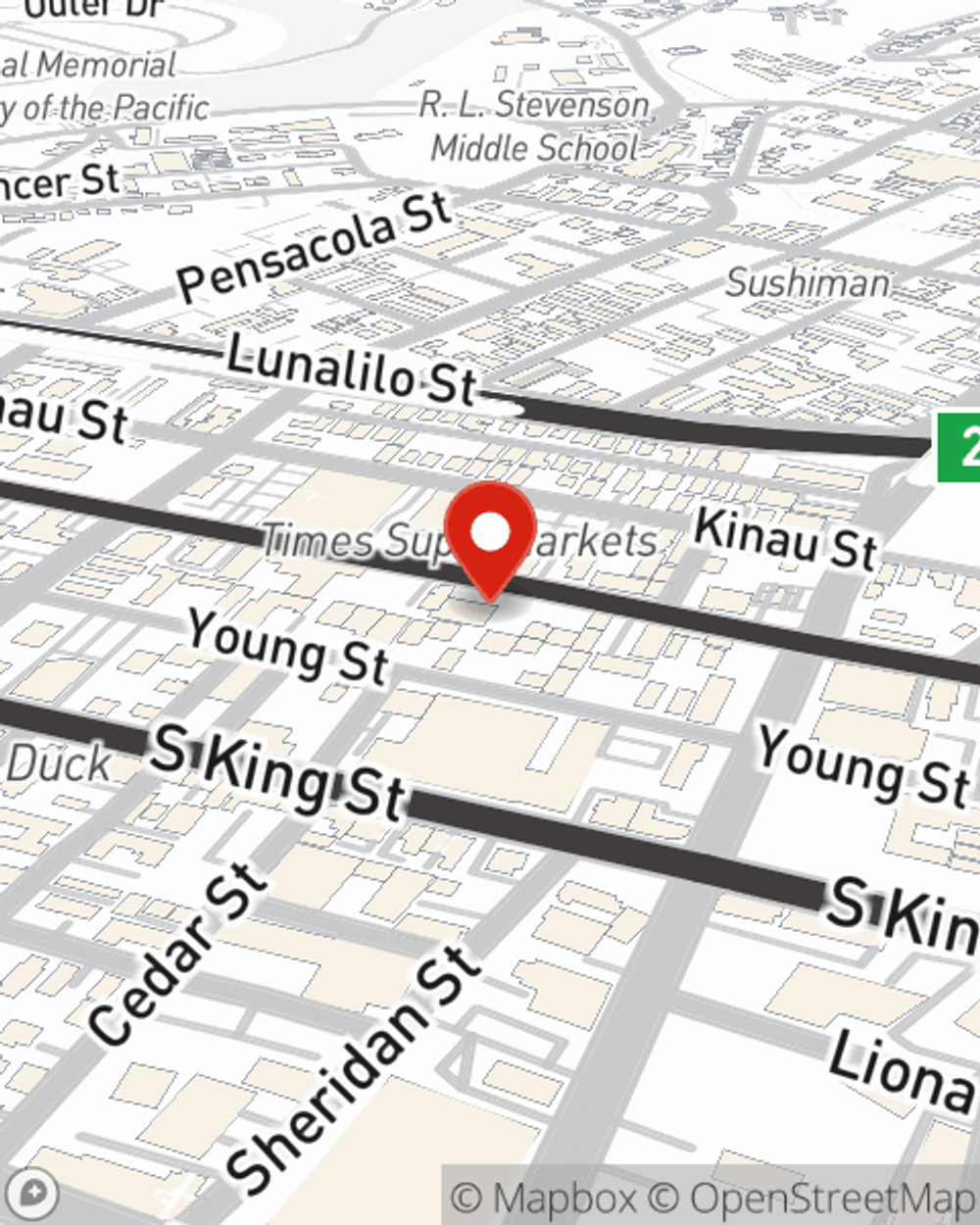

Call or email State Farm Agent Sue Ann Lu today to discover how the leading provider of renters insurance can protect your possessions here in Honolulu, HI.

Have More Questions About Renters Insurance?

Call Sue Ann at (808) 587-6116 or visit our FAQ page.

Simple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Simple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.